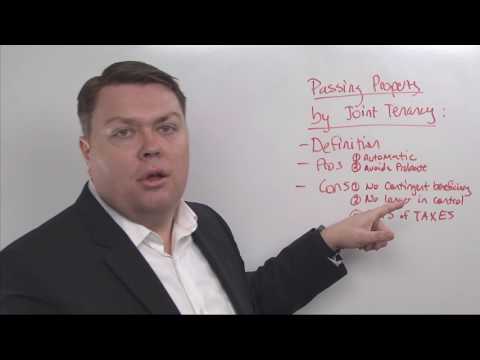

Music welcome back. I'm Greg with the Ashcraft firm, and I'm an estate planning attorney. Over the last couple of weeks, we've talked about two ways to pass property at the time of death. This week, we are going to discuss the third method. In week one, we discussed what happens to an estate if no action is taken - the property will pass through probate. We also discussed the advantages and disadvantages of probate. In the following week, we talked about passing property through a contract and the pros and cons of doing so. This week, we will delve into the benefits and drawbacks of passing property through joint tenancy. But what exactly is meant by passing property through joint tenancy? This term is commonly used in deeds and refers to joint tenancy with the right of survivorship. It is an alternative way of owning property, as opposed to tenants in common. Essentially, if you own property with another person, you can either hold it in joint tenancy or as tenants in common. Holding property separately is another option, but for multiple owners, joint tenancy or tenancy in common must be chosen. If property is held as tenants in common, each owner possesses a percentage of the property. For example, my wife and I hold our property as tenants in common, each with a 50% share. If one of us passes away, that 50% share held as tenants in common will go through probate. However, with tenants in common, there is flexibility in deciding who inherits your share. For instance, it is possible to leave your tenant in common share to anyone through a will, rather than automatically going to another owner listed on the deed. On the other hand, holding property in joint tenancy with the right of survivorship means that...

Award-winning PDF software

Community property with right of survivorship texas Form: What You Should Know

Holding title as community property with right of survivorship gives married couples the hybrid benefits of joint tenancy and community property: you avoid spouse's maintenance obligations and property taxes; you inherit from each other (at least as much as you can with community property); you have equal rights to any life insurance proceeds; you can both deduct property taxes from your income, and you can both use your jointly owned property as collateral and claim interest on each another assets; and you can each use up to 25% (twice the amount) of your income for retirement savings contributions. SECOND AMENDMENT TO COMMUNITY PROPERTY LAW Section 112.06. Right of Survivorship. (a) In General. Notwithstanding any other provision of law, community property passes to a surviving spouse or spouse's estate upon the death of a decedent without any condition or requirement that the spouse or estate acquire or continue community property rights over the decedent's jointly owned property. (b) Exceptions.

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Ca Interspousal Transfer Grant Deed, steer clear of blunders along with furnish it in a timely manner:

How to complete any Ca Interspousal Transfer Grant Deed online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Ca Interspousal Transfer Grant Deed by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Ca Interspousal Transfer Grant Deed from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Community property with right of survivorship texas